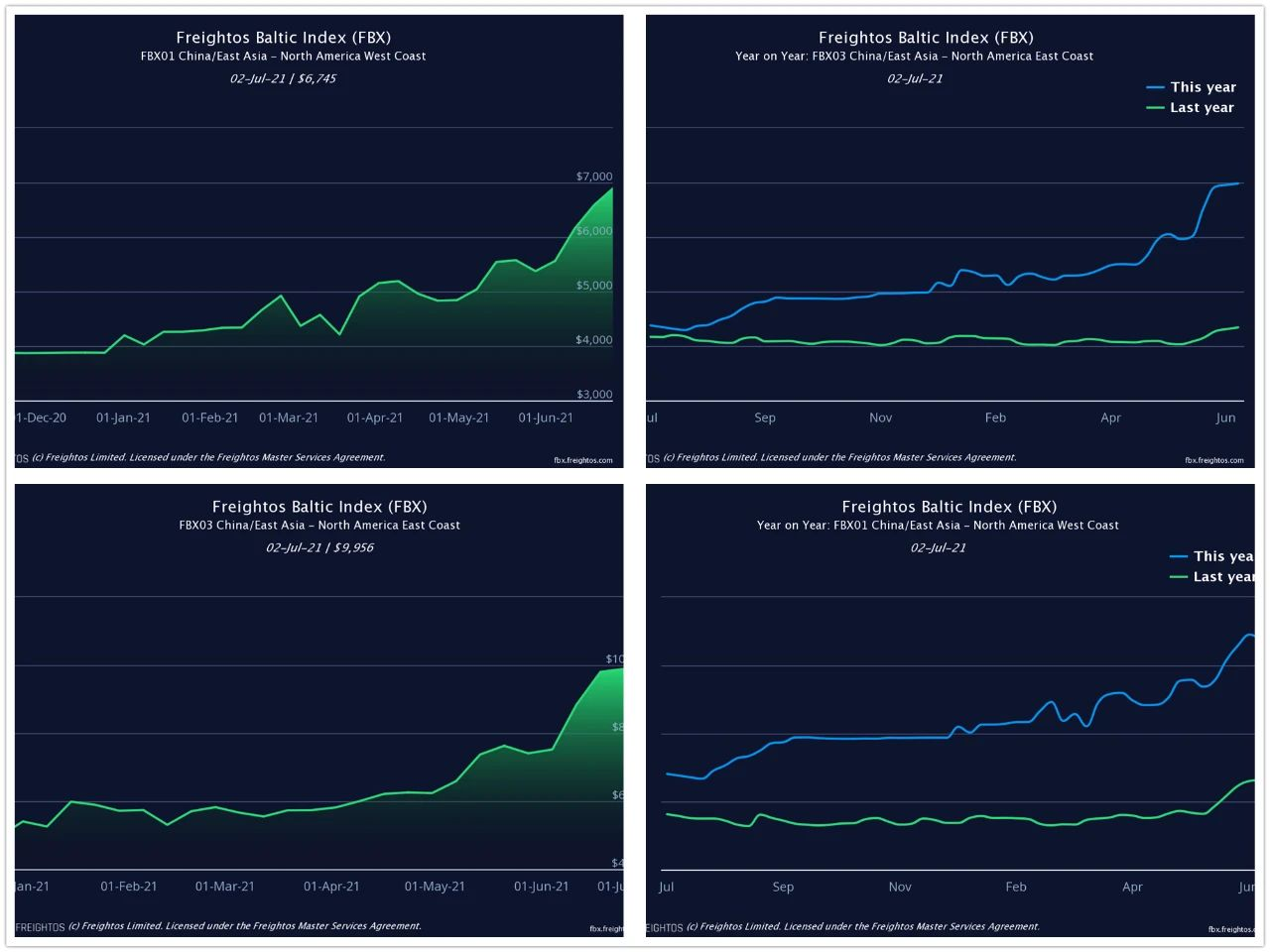

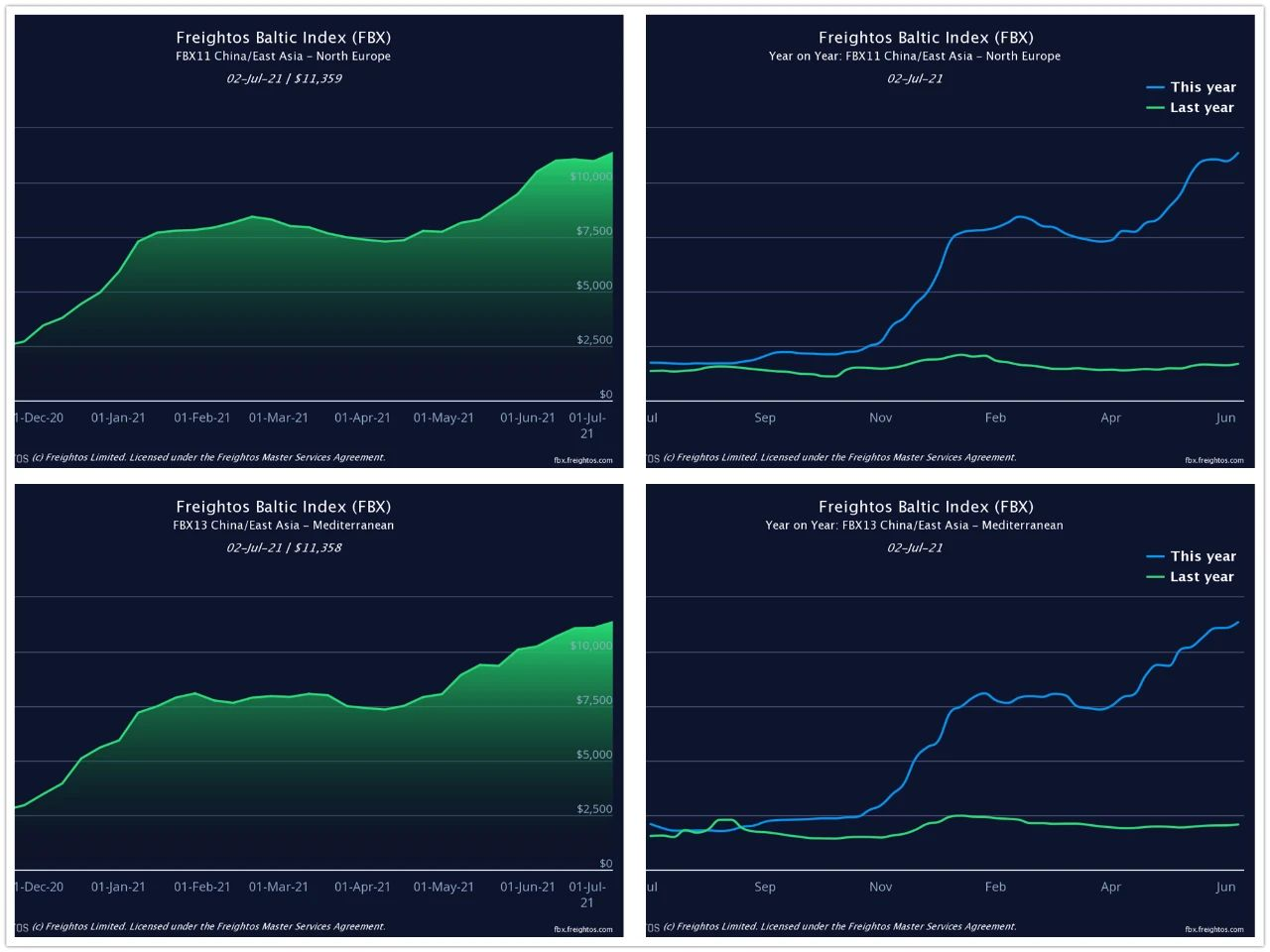

Guide The transportation capacity of Yantian Port has resumed normal operations, and the delay continues due to a large backlog of cargo. The market is facing various problems caused by cargo backlog, ship delays, port jumps and shortage of space. With the soaring demand, market participants have begun to make long-term preparations for alleviating the current congestion situation, and now every container ship that can sail is very much in demand. The demand for capacity in order to cope with the transportation of a large number of goods around the world means that almost all available container ships have been put into use. Due to the shortage of capacity, there was another batch of new ship orders last week, including Seaspan , HMM and Wan Hai, which all increased shipbuilding orders. However, none of this will help solve the looming crisis in the container transportation supply chain. Congestion in ports and inland areas is leading to a shortage of available equipment, which continues to affect the development of the troubled container supply chain. Søren Toft, CEO of Mediterranean Shipping , delivered a speech at the International Ports and Ports Association Conference, calling on ports and carriers to strengthen cooperation to solve this problem. But he warned that more investment is also needed and called for a " long-term strategic vision " for infrastructure investment . Following the congestion in Los Angeles, Long Beach, and Yantian, ports that are seen as obstructing the transportation of containerized goods have become the main bottleneck and have attracted more and more attention. CMA CGM said last week that it plans to suspend its South American route in Le Havre for three months due to port congestion and inefficient operations . Prior to this, The Alliance also issued a similar statement, saying that due to the severe congestion in Rotterdam, it was forced to call on 7 voyages to the Port of Rotterdam . Freight rates on European and American routes continue to rise The shipping market has entered the traditional peak season, and the freight rates of European and American routes have skyrocketed. For the first time, the freight rate of the US Eastern Route has exceeded the sky-high price of US$ 9,000 /FEU . According to the Shanghai Containerized Freight Index ( SCFI ) in 7 Yue 2 latest tariff data released last week SCFI index continued to rise to 3095.14 points over the previous period soared 119 points, or 3.2 percent . The Shanghai Export Container Freight Index continued to break new historical highs. The quotations of all major routes have risen across the board. The freight rate of the US Eastern Route has soared by US$ 310 to reach US $ 9,254 /FEU , an increase of 3.46% ; the freight rate of the US Western Route has also risen by US$ 228 to US$ 4,944 /FEU , an increase of 4.8% . The shortage of container equipment, the continued congestion of the port and the shortage of capacity will further push up the freight rate in the second half of the year. Even premium services cannot guarantee space. European tariff lines rose 307 Meiyuan to 6786 Meiyuan / TEU , rose 4.7 percent , the Mediterranean route freight rates continue to rise until 6655 Meiyuan / TEU , rose 2.1 percent , both record high levels. Statistics show that since the second quarter, the SCFI freight index has shown a continuous upward trend in 12 of the 13 weeks . The current freight rate has increased significantly compared to the beginning of the year. The SCFI freight index in the second quarter averaged 3240 points, which was significantly higher than that. The average of 2782 points in the first quarter . Especially for the US Eastern Route, the current freight rate of US$ 9,254 /FEU is almost twice that of about US$ 4,700 /FEU at the beginning of the year . Asia - North America (trans-Pacific route): Due to port congestion, surge in demand, and capacity in short supply, the pressure of empty container rotation has increased, and the space on the west and east coasts of North America is tight, and freight rates have increased. Shipping companies have restricted cargo from inland points; shipping schedule delays, capacity imbalances, inland transportation delays, coupled with the continued strong demand for imports in the Americas, shipping companies announced the August GRI increase and the collection of port congestion charges PSS ; in multiple Under the influence of factors, the freight rate will rise further in July. Baltic Exchange last week and Freightos launch of the global container freight index ( Freightos Baltic Index ) to display the Nordic freight index for every 40 Yingchi 11359 dollar rose 3 percent , the Mediterranean freight index 11358 dollar rose 2 percent , while the US West Coast FBX The index is US$ 6,745 , and the FBX Index of the East Coast of the United States is US$ 9,956 . FBX- US East and West Asia - Europe route: Due to the backlog of cargo in June , market demand is still strong; terminal congestion continues to worsen, and shipping delays are expected to be as long as 5-15 days; European / Mediterranean market demand is strong, space is still very tight, and freight rates will continue rising. FBX- Nordic Mediterranean The third quarter will usher in a super peak season, with freight rates skyrocketing Industry insiders pointed out that since the beginning of this year, problems such as lack of ships, lack of containers, lack of labor, and port congestion have been superimposed. With the unblocking of Europe and the United States in June , the market entered the traditional peak season, and demand far exceeded the supply of capacity. , Driving the freight rate to skyrocket, it is expected that the SCFI freight index is expected to break through the 4000- point mark this week , driving freight rates to explore new sky-high prices. With 7 , 8 Yue series of the world's major shipping companies to hike tariffs, if included in Peak Season Surcharge, fuel, cabin fees to buy additional costs to the United States and the Far Eastern Freight currently up 1.5 Wan -1.8 million dollars / FEU , US West also has exceeded 1 million US dollars / FEU , Europe tariff lines approximately 1.5 Wan -2 million dollars / FEU . Analysts said that this year 3 Yuedi since the Suez Canal Cypriot ship incident, the European port congestion further intensified, Yantian and near the port was closed for reasons epidemic is even worse. Although the Yantian Port has resumed normal operations, it still cannot be fully digested in the short term, and the congestion situation in the US port has not improved so far. The third quarter of this year is expected to usher in a super peak season for container shipping companies. The American Retailers Association estimates that as retailer inventories are still at a low point in the past 20 years, the strong demand for restocking will continue to push up the freight rate. Consulting firm Hackett Associates is optimistic that the U.S. container imports will reach more than 29 million TEU in 2021 , a substantial increase of 14.5% over 2020 . This move will benefit Asian producing countries such as China, Japan, and Vietnam. The United States’ imports from mainland China will increase by 51.5% annually, and imports from other parts of Asia will increase by 44.5% . Liner company will make up to 100 billion U.S. dollars in profits this year Drewry currently predicts that the container shipping industry will achieve a record profit of 80 billion U.S. dollars in 2021 , higher than the previous forecast of 35 billion U.S. dollars. If the freight rate exceeds expectations for the rest of the year, Drewry said that the annual profit line of 100 billion US dollars is not impossible, which will be more than three times the highest liner record in history. The British consulting company pointed out: "2021 will be the first time in the history of container shipping. In the context of huge operational disruptions in ports and shipping systems, carrier profits will approach 100 billion U.S. dollars and average freight rates will increase by 50% . " Drewry predicts that from the peak season to the end of the third quarter, container volume will continue to grow and end the year with an annual growth rate of about 10% , consolidating a record year for the industry. As far as 2022 is concerned, Drewry said there will still be growth, but with the lifting of epidemic-related restrictions, it is expected that consumer spending will shift to the service industry, and the growth may be only about half of that. For 2022 , Drewry expects EBIT to fall by more than one-third due to weaker freight rates and rising costs. As many carriers lock in expensive long-term contracts, costs may remain at a higher level for a longer period of time. Lars Jensen , CEO of Vespucci Maritime, a container consulting company, studied the $ 100 billion profit figure proposed by Drewry and believed that container shipping would make up for 20 years of losses within one year . The cost of transportation between China and East Europe continues to rise Since October last year , ocean shipping prices have risen abnormally, and there is no sign of decline. In addition, the problem of container delays is extremely serious. Many ports are facing a shortage of workers, and the processing time for containers is longer than usual. Container ships may experience a delay of 2-3 days each time they enter the port , which may increase the voyage by as much as 10-15 days. According to the manager of a Jining company specializing in ginger trade and export, “ Under normal circumstances, the journey from Shandong to Moscow should be only about 45 days, but due to low loading efficiency, the journey slows down to 60 days. As for the price, it used to be around US$ 3,000 each. Containers, each container is now as high as 9,000-10,000 U.S. dollars. " " The price of land transportation to Russia is also rising. The current price of land transportation is around 4,000-5,000 U.S. dollars per truck . When the price of overseas transportation began to rise in October last year , Many exporters turn to land transportation. " Write at the end The world's industrial chain relies on China's supply, and the trade deficit has increased; China's ports continue to be in short supply of containers, the operation efficiency of the destination port is low, and the supply chain cannot operate normally. The situation in the maritime market will cause further tensions in air and rail services. (The content is organized from Shipping Network, International Shipping Network)

Hello, welcome to the official website of FINANCE KEY INTERNATIONAL HOLDING CO,LTD!